Tax is an important means for the country to achieve redistribution, and corporate tax is also a key link in the business process, such as the more common consumption tax, business tax, corporate income tax, value-added tax, etc., but how are these taxes calculated?

税收是国家实现再分配的重要手段,而企业税收也是企业经营过程中的关键环节,如比较常见的消费税、营业税、企业所得税、增值税等,但这些税收是怎么进行计算的?

I. Value-added Tax

一、增值税

1. General taxpayers

1. 一般纳税人

Tax payable = Output tax - Input tax

应纳税额=销项税额—进项税

Output Tax = Sales x Tax rate The tax rate here is 17%

销项税额=销售额×税率此处税率为17%

Component assessable price = cost x (1 cost margin)

组成计税价格=成本×(1 成本利润率)

Component assessable price = cost ×(1 cost margin)÷(1 - consumption tax rate)

组成计税价格=成本×(1 成本利润率)÷(1—消费税税率)

Input tax of prohibited deducters = total input tax of the month ×(total of sales of tax-free items and turnover of non-taxable items in the month ÷ total Sales and turnover of the month)

禁止抵扣人进项税额=当月全部的进项税额×(当月免税项目销售额,非应税项目营业额的合计÷当月全部销售,营业额合计)

2. Imported goods

2.进口货物

Tax payable = component assessable price x tax rate

应纳税额=组成计税价格×税率

Component assessable Price = Customs value Customs duty ( consumption tax)

组成计税价格=关税完税价格 关税( 消费税)

3. Small-scale taxpayers

3.小规模纳税人

Tax payable = sales x levy rate

应纳税额=销售额×征收率

Sales = tax sales ÷(1 levy rate)

销售额=含税销售额÷(1 征收率)

Ii. Consumption Tax

二、消费税

1. General situation:

1.一般情况:

Tax payable = sales amount x tax rate

应纳税额=销售额×税率

Sales excluding tax = sales including tax ÷(1 VAT rate or levy)

不含税销售额=含税销售额÷(1 增值税税率或征收率)

Component assessable price =(cost profit)÷(1 - consumption tax rate)

组成计税价格=(成本 利润)÷(1—消费税率)

Component assessable price = cost ×(1 cost margin)÷(1 - consumption tax rate)

组成计税价格=成本×(1 成本利润率)÷(1—消费税税率)

Component assessable price =(material cost processing fee)÷(1 - Consumption tax rate)

组成计税价格=(材料成本 加工费)÷(1—消费税税率)

Composition assessable price =(customs value customs duty)÷(1 - Consumption tax rate)

组成计税价格=(关税完税价格 关税)÷(1—消费税税率)

2. Levy by quantity

2.从量计征

Tax payable = sales quantity x unit tax

应纳税额=销售数量×单位税额

Iii. Customs Duties

三、关税

1. Levying taxes on value

1.从价计征

Tax payable = quantity of taxable imported goods × unit customs value × applicable tax rate

应纳税额=应税进口货物数量×单位完税价×适用税率

2. Levy by quantity

2.从量计征

Tax payable = Quantity of taxable imported goods x tariff unit tax

应纳税额=应税进口货物数量×关税单位税额

3.compound levy

3.复合计征

Tax payable = quantity of taxable imported goods × unit duty amount quantity of taxable imported goods × unit duty value × applicable tax rate

应纳税额=应税进口货物数量×关税单位税额 应税进口货物数量×单位完税价格×适用税率

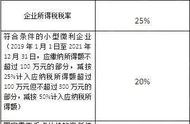

4. Enterprise income tax

四、企业所得税

Taxable income = Total income - amount allowed for deduction

应纳税所得额=收入总额—准予扣除项目金额

Taxable income = total profit tax adjustment increase - tax adjustment decrease

应纳税所得额=利润总额 纳税调整增加额—纳税调整减少额

Tax payable = taxable income x tax rate

应纳税额=应纳税所得额×税率

Monthly advance payment = monthly taxable income ×25%

月预缴额=月应纳税所得额×25%

Monthly taxable income = taxable income of the previous year x 1/12

月应纳税所得额=上年应纳税所得额×1/12

,